Warning : This article is brought to you by the company APWine. Crypto investments are risky by nature, do your own research and only invest within the limits of your financial capabilities. This article does not constitute an incentive for investment

The APWine protocol allows you to tokenize your future returns in the market

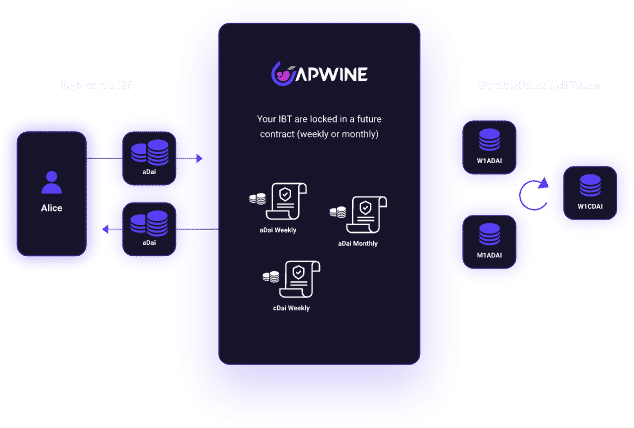

So let’s start very concretely by understanding how the APWine protocol works and especially how to take advantage of it to tokenize your future DeFi returns. The first thing to do is deposit your funds on the APWine platform. For example, if you generate returns on your DAIS using the AAVE protocol, you will be able to deposit your aDAI on APWine. You can choose to block them for a period that automatically renews on a weekly or monthly basis. Once you validate the operation, your aDAI if one continues on this example will be blocked on the platform until the end of the period you have defined.

Once you have completed this step of depositing and blocking your funds over a period with the APWine platform, it is now that the protocol takes on its full meaning since you will be able to tokenize your future returns still unrealized to date. These tokens meet the Ethereum ERC20 standard and you can therefore trade them on any decentralized exchange (DEX) of your choice. APWine has also developed an exchange dedicated to trading these tokens representing future returns.

On the APWine platform, you will be able to monitor at any time the evolution of the realization of your returns over the period you have determined. Once the period is over, you can directly recover your returns since these are now realized. In exchange, the associated future yield token is burned.

The pools available on the APWine platform are currently 3 in number, it is planned to evolve quickly with a number of possibilities that will be multiplied. In the meantime, yields from the AAVE, Yearn Finance and Harvest Finance protocols can already be deposited.

A well-surrounded project that moves fast and well

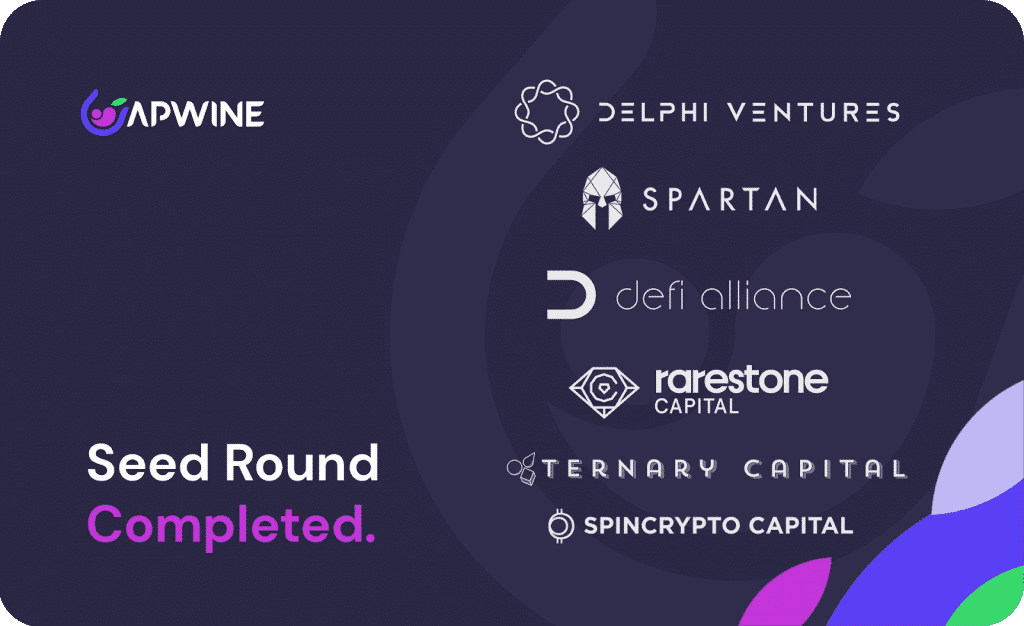

To take the temperature of a project, it is always a good idea to look at how it manages to pass the important milestones. With APWine, the milestones passed successfully and at a well-sustained pace. As proof, the launch of the platform in Beta version was carried out in February 2021, a month later the teams completed a fundraising in seed to the tune of one million dollars.

Let’s stop for a moment on this first fundraising because it is worth the detour, we find in particular investment funds Delphi Digital and Spartan Groupbut also some key players in the decentralized finance sector. We may notably mention Marc Zeller of Aave, Doo Wan Nam and Gustav Arentoft of Maker Foundation or Simon Polrot, former president of theADAN and founder ofEthereum Canada and Julien Bouteloup, president of Stake Capital who supported the initial launch of the project as Business Angel.

During this first fundraising, 3 million APW tokens were distributed to the various investors who shared 6% of the total amount of tokens at a price of $ 0.33 per APW token-all for an initial valuation of the project at more than $ 16.5 million.

An important step that allows the core team of the project to expand with the arrival of two full-time developers who are in charge of the technical development of the smart contract part but also the development of the design of the platform. Finally, the team is complemented by a community leader whose role is to make the community live and maintain APWine which grows by the day.

APW, all about the Apwine token

How to talk about the project APWine not to mention the APW token, impossible will you tell me ? Indeed, beyond the fact that the name of the token is integrated like a good glass of red wine in the title of the project, it plays and will play a central role in the latter.

The APW token is built on the Ethereum ERC-20 standard, its role will be important in the governance of the project. Blocking its APW tokens over a certain period that can go up to two years will thus allow votes to govern the project. The longer you block your APWS, the more power you gain within the governance mechanism.

The importance and usefulness of the token does not end there; indeed, as a holder you benefit from the 5% fees collected by the platform on all returns that are deposited and tokenized on APWine. Finally, a portion of the fees collected from the swaps is intended to be redistributed to the holders of the APW token. The percentages of fees may change according to the decisions of the DAO.

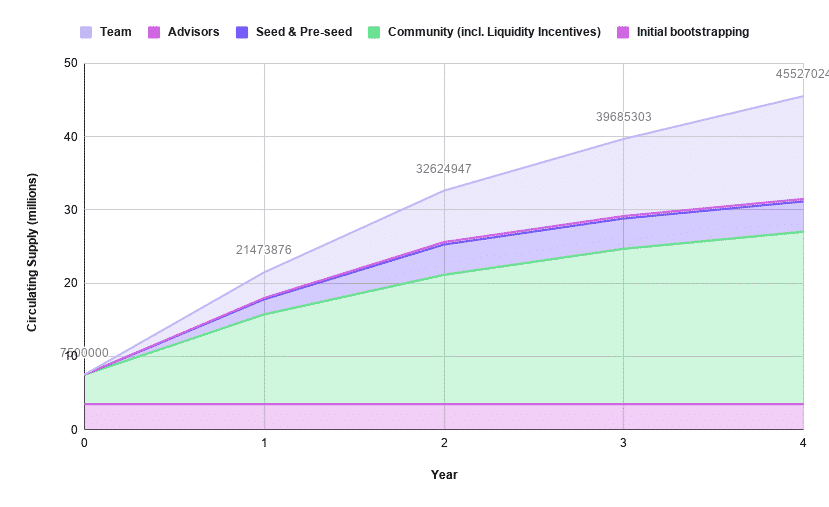

The issuance of APW tokens is limited to 50 million. There will not be one more, and this issue will be made in a decreasing way over the years. According to the elements provided by the APWine teams, it can be seen that it is planned to have issued for 32 million tokens 2 years after the launch of the project. Enough to make the APW rare enough on the market to ensure the value of its price in the long term.

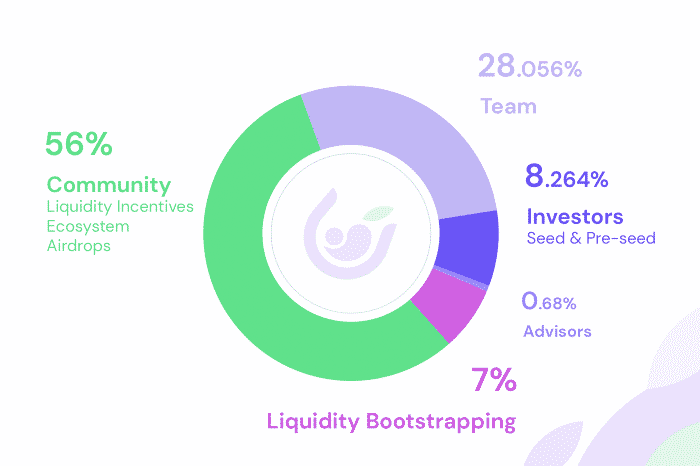

APW tokens are planned to be distributed in the majority (56%) to the community to stimulate the ecosystem through events but also via Airdrops and a liquidity mining program that will reward the early adopters of the project, as well as those who maintain trading pairs on decentralized exchanges. On the other hand, investors and advisors share just over 8.5% of the total, the team takes 28% and finally investors who took part in the IOT finalized very recently share 7% of the total liquidity.

Feedback on a successful IOT

The last time we told you about the APWine project on Cointribune this was especially to announce the imminent launch of their Initial Dex offering. It took place from 19 to 21 May. If you remember correctly, this did not fall at the best time: between the tweets ofElon Musk and the big correction of the market, it must be said that APWine had not foreseen that a storm of this magnitude would fall on the fresh bunches of grapes. Despite the storm of the market, the IOT allowed to distribute APW tokens worth $ 5 million, enough to continue to fuel the rocket. As transaction fees have been very high for the majority of IOT participants, APWine plans to quickly perform an airdrop for the 851 contributors who distribute the first APW tokens available to the general public.

Now that this step is successful, APWine has entered an important audit phase to ensure the security of the protocol. As we know, this phase is essential for DeFi projects that must avoid the bad buzz generated by a security flaw in the code.

Conclusion: APWine, the beginning of a beautiful story

Project APWine, that’s all we love about Cointribune : an innovative DeFi protocol, an ambitious team and strong supports that bring all the legitimacy that this project deserves. You will have been able to follow the debut of this project in preview on the crypto media number 1 and our little finger tells us that we have not finished hearing about the winegrowers in the middle of the DeFi. In any case, we will continue to follow all this closely because after the IOT, the project aims for a new phase on the well-known decentralized exchange SushiSwap with APW/ETH trading pair.