The wonderful thing about cryptocurrencies is that when you thought you had seen everything, something else comes up. An ecosystem where innovation is particularly noticeable when it comes to attacking DeFi protocols. But also to divert from it the operating model considered doubtful or ideologically incorrect. This gives rise to experiences that are as amazing as they are sometimes funny, when it is the funds of others that are stuck in them. A logic that seems to have made the “innovative” tokenomics of the Tomb Finance project, the hole in which its TOMB token has just been buried.

The attacks faced by the DeFi are causing record harm. This with more than 360 million dollars flown in the first half of this year alone. And the emptying of pools of liquidity that follow one another to attacks that we still wonder what the true meaning was. An area where each new deal increases a slate that weighs largely on its users and other liquidity providers. And that there is no downside in the current state of affairs.

And sometimes in the middle of this digital battlefield some diversions stand out. For example, these governance attacks that hijack a community vote. This with the help of a flashloan loan and a strong dictatorial will to tilt the urn in its direction. And more recently the implementation of a token whose resale could result in a tax of up to 20% of the amount of the transaction. This did not fail to draw attention to the Tomb Finance protocol that is at the origin. As well as causing the collapse of his TOMB token.

The TOMB token from the Tomb Finance project

The question is not even whether this principle of taxing the TOMB token made sense. In any case, this is an economic model that is nothing new. Especially in the context of the operation of a stablecoin with decentralized ambitions. Which in this case was based on an objective to index its price to that of Fantom’s FTM. A very strange idea, since the latter is neither stable nor even particularly resistant to market volatility. And an operation that can very clearly be classified in the category of highly risky monetary experiments.

But this was the ambition displayed by the Tomb Finance protocol. With as a somewhat coercive control tool, the application of a tax on the resale of TOMB tokens. The latter increases (up to 20%) depending on the distance it maintains with its predefined exchange level (peg). “Gatekeeper fees” are then used to try to balance this machine, thanks to a burn or resale principle in order to increase liquidity. But whose high amount visibly irritated an investor eager to leave this adventure. And he didn’t do things by half…

A tax exemption attack

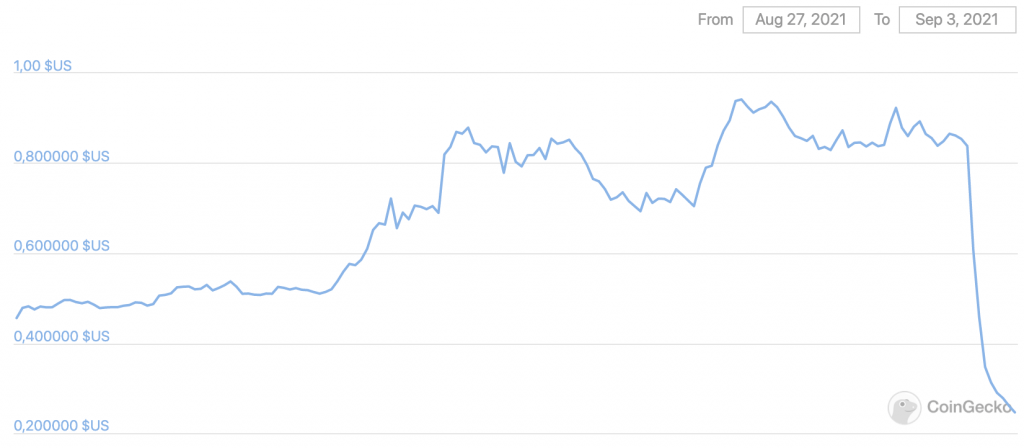

For it seems that this investor managed to find a loophole in this taxation process. A discovery that obviously allowed him to withdraw his funds without having to pay the bill. And that he did not fail to share immediately on the site notomb.tax. This by stating that ” there will be a fee to do this, but that they are well below the actual Gatekeeper fee “. An option that quickly attracted the interest of TOMB token holders. And that forced the Tomb Finance project to disable this penalty in order to stop a real hemorrhage. At the risk of losing the revenue necessary to maintain the anchoring of its token to the FTM.

« Everyone, there has been some kind of feat in the guardian’s tax system. Some unknown people posted a link to a third-party website that allowed users to sell TOMB without paying the Gatekeeper tax. “- Tomb Finance

An operation that quickly triggered a snowball effect. And who has seen the token FALL to the depths at the pace of ever-increasing resales. But is it really an attack in the true sense of the word ? Or the release of investors “trapped” in a model of operation that was nevertheless very clearly displayed on the project site ? The question remains whole, while some rumors indicate that the team behind the project reportedly tried to plug the gap by tapping into the funds of its DAO. And this while she was aware of this case for several weeks.

A case that does not fail to raise certain questions. As the purpose of this token anchored to an FTM that already exists and has no need for a clone. Or this punitive tax that prevents investors from disposing of their funds without having to pay the price. But also this logic that makes investors destroy the project in which they have nevertheless placed money. And this most of the time because they had obviously not taken the time to read the terms of a contract which – however absurd they may be-were clearly exposed. A question that will obviously not be answered quickly.