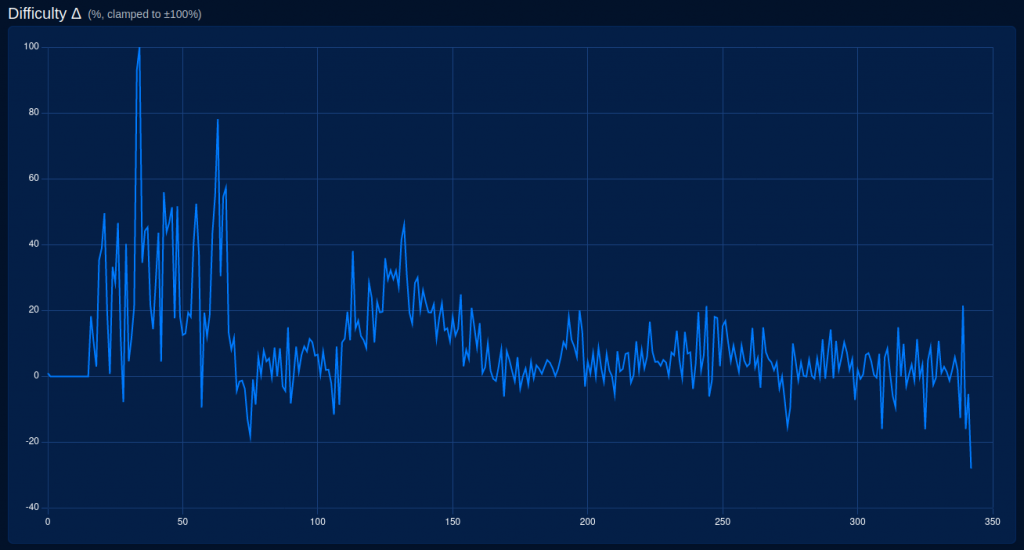

The “difficulty” of bitcoin fell by 28% last Saturday. Unheard of. Here is the why of the how.

Mining difficulty at a year low

“Difficulty” refers to the computing power required to mine a block. We talk about “hashrate ” because miners are frantically looking for a particular hash (we’ll come back to that). This difficulty adjusts every 2610 blocks (about 18 days called an “epoch”). The goal is to maintain the average pace of one block every 10 minutes.

An increase in difficulty indicates that the average time to search for a hash during the previous adjustment era was less than 10 minutes (due to the increase in the number of miners joining the network and searching for a valid hash).

A decrease in difficulty indicates that miners have left the network and it now takes more than 10 minutes to find a hash (block). We have a slowdown.

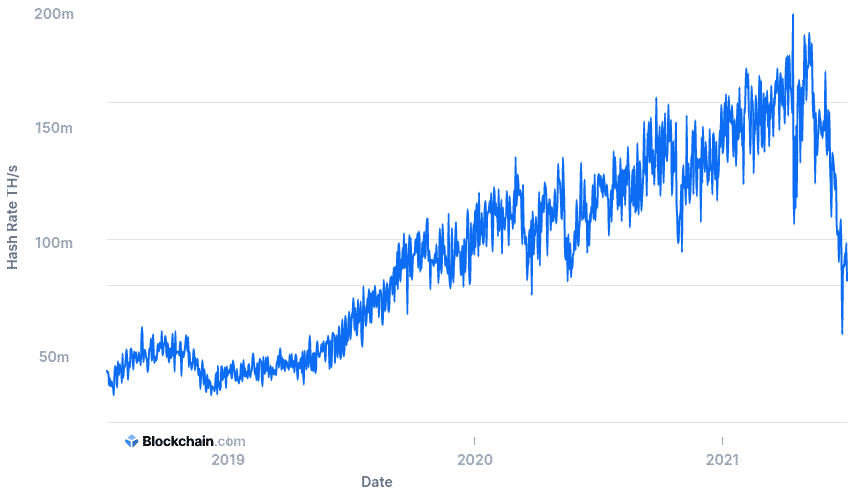

We were recently in the latter case due to the exodus of Chinese miners. The latter have been asked to move as China is currently experiencing its worst energy crisis in a decade.

Chinese machines will take many months to find a home so this difficulty adjustment is a boon for the remaining miners. Indeed, the same number of bitcoins will be created with each block with fewer miners to share the cake.

« A miner that plugs in now gets the same return on investment as when bitcoin was at $ 50,000 “, Zhang told Coindesk.

What is this hash thing ?

Bitcoin mining is ultimately nothing more than a race to find a hash. A hash is a series of 64 numbers and letters. Here is for example the hash of the very first block of the bitcoin blockchain :

00000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

This kind of hash is obtained by passing any amount of data into an encryption algorithm called a ” hash function “. In the case of bitcoin, we use the SHA-256 hash function by bringing it several essential data :

– Transactions of the last ten minutes (Merkle tree)

– The hash of the previous block (hence the expression ” blockCHAIN “)

– A random number that you just have to vary to get a new hash (the nounce)

Miners will hash all this data with SHA-256 repetitively until they find a hash starting with a specific number of zeros. Currently, the hashrate of bitcoin is 80 Eh / s. Put another way, the set of miners produces 8×1018 hash per second. Statistically, the average time it takes to find a valid hash will be 10 minutes.

A valid hash is a hash starting with a number of zeros. It is much more likely to find a hash starting with a single zero than 15 zeros. The difficulty adjustment is made by claiming a hash starting with more or less zeros.

[Cela étant dit, la réalité est légèrement plus compliquée car ajouter ou retirer un seul zéro se traduit actuellement par une multiplication par deux de la difficulté. Plus de précisions ici pour les puristes.]

Adjusting the difficulty every 2610 blocks aims to preserve an average interval of 10 minutes between each block of transactions. As soon as a miner finds a valid hash (starting with the right number of zeros), it broadcasts it to the network for node verification. As soon as 51% of them have validated the hash, the transactions contained in the block are confirmed and the lucky miner is rewarded via the creation ex nihilo of new bitcoins (6.5 BTC). This process is called the ” Proof of Work “.

Why “10 minutes” ?

This is a compromise chosen by Satoshi by taking into account the propagation time of the new blocks for verification by nodes around the world. The problem here is the bandwidth of the internet in some regions.

We can read in the White paper of bitcoin that these ten minutes are also there to not overload the blockchain. The size of the blockchain is indeed a central element in the decentralization of bitcoin. It is currently 400 GB and therefore fits in a lambda hard drive.

Create blocks of more than 1 MB (a proposal that was the origin of the ” Big Block War “) is just as problematic as creating one block per minute instead of 10 minutes. By creating blocks every minute, the BTC blockchain would be 10 times larger and would already exceed 4000 gigas. This would then be a threat to its decentralization because not all nodes have the means to invest in expensive hard drives.

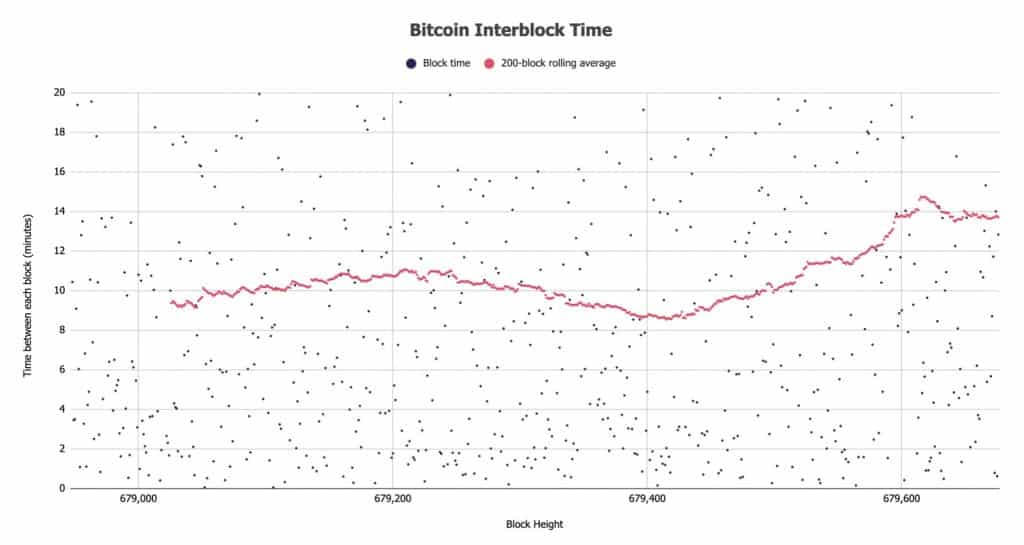

Let’s finish with this superb representation of the time taken to find each valid hash. We can see that it is not uncommon for a hash to be found after a single minute or after 20 minutes. The long-term average, however, hovers around 10 minutes :

Journalist / Bitcoin, geopolitics, economy, energy, climate

DISCLAIMER

The words and opinions expressed in this article are the sole responsibility of the author and should not be considered as investment advice. Conduct your own research before making any investment decisions.